|---Module:text|Size:Small---|

Artificial Intelligence (AI) is seen as the next big thing across industries and the Financial Services sector is one of the two leading sectors investing in and adopting AI. The fact that AI processes are much more efficient in identifying data patterns than humans leads organisations to include AI in their business strategy, allowing them to understand their target audience and gain insights.

Some numbers

A study conducted by PwC revealed that 52% of the financial services institutions have been making considerable investments in AI and 72% of business decision-makers assume that AI will be the business advantage of the future. Besides, global investment in AI is set to hit USD 98 billion by 2023, according to the International Data Corporation.

How AI is impacting the banking industry

Artificial Intelligence uses deep learning, predictive analytics and machine learning for an improved banking experience. Thanks to AI, fraud detection, risk assessment, cost reduction and enhanced customer experience are achieved.

In fact, the Banking industry benefits from AI in combating frauds and hacks while adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance regulations. Besides, Machine Learning (ML) has become an important feature in Banking, leading to infinite possibilities as it continues gaining ground.

According to Forbes, particularly large banks are industry leaders adopting AI. Their goals? To stay ahead of the competition, provide greater customer service to customers, present more relevant services and offerings, and ultimately to help to transform many back-end processes.

Deloitte surveyed 206 US Financial Services executives in 2018 to understand how their companies are using AI technologies and the impact it’s having on their business. The report was able to identify some key characteristics of the different respondents:

- Embed AI in strategic plans, “integrating AI into an organisation’s strategic objectives has helped many frontrunners develop an enterprise-wide strategy for AI, which different business segments can follow. The greater strategic importance accorded to AI is also leading to a higher level of investment by these leaders”;

- Apply AI to revenue and customer engagement opportunities, “most frontrunners have started exploring the use of AI for various revenue enhancements and client experience initiatives and have applied metrics to track their progress”;

- Use multiple options for acquiring AI, “frontrunners seem open to employing multiple approaches for acquiring and developing AI applications. This strategy is helping them accelerate the adoption of AI initiatives via access to a wider pool of talent and technology solutions”.

Furthermore, still according to Deloitte, banks can unlock opportunities by placing AI on top of the banking data in four ways:

- Personalisation, “AI can generate customer insights that can be used for personalised communication, advice, offers and services”;

- Productivity gains, “nearly the top 20% of back-office work accounts for 85% of the cost. Labour-intensive work like compliance reporting, new customer onboarding communications, and documentation can become highly accurate and efficient with AI-powered automation”;

- Fraud detection and compliance, “fraud detection has been the hotspot for AI application in banking. AI’s increased potential for real-time sensing and improved ability to spot anomalies make it highly valuable in this regard”;

- Customer recommendation, “AI can enable banks to provide quality advice to customers by removing ‘human error’. AI-powered personalised finance management tools hold great potential in the market”.

However, as Deloitte advances, despite all the eagerness to cater to the benefits of AI, banks tend to be slower to adopt new solutions. In fact, according to McKinsey estimates, banks don’t realise the value of more than 80% of the total data collected by them. Also, while the foundations are in place, the banks have been following a watch-learn-act approach.

The perks of AI for the CX

Through the use of AI, banks can reduce costs, mitigate risks, increase revenue, and ultimately improve the customer experience. This can be achieved because AI can unleash value across the customer experience by autonomously collecting data and generating actionable insights to make intelligent, convenient and informed customer-wise decisions.

According to Celent’s research [1], applying AI to the banking customer lifecycle, while continually managing risk and fraud, can help banks across four key phases: acquisition; servicing, nurturing/retention; and growth.

Gartner’s survey showed that 77% of the surveyed board members view AI as one of the biggest game-changers, if not the biggest, for their organisations. The real challenge is to turn the promise that AI holds into tangible use cases in CX. In addition, interactions with Gartner’s clients show that, for many AI initiatives, they struggle to:

- Select suitable use cases that contribute clearly to their business objectives (this note focuses on CX priorities);

- Build and maintain momentum by focusing on quick wins early on;

- Prove ROI by attributing and quantifying benefits.

Additionally, Gartner’s AI and ML Development Strategies Study found that improving the customer experience was the number one motivation for organisations that had already deployed AI/ML initiatives or were planning to do so imminently [2].

Assumptions for the near future

Gartner advanced some strategic assumptions for years to come concerning the impact of AI on the CX.

- By 2022, 20% of customer service will be handled by conversational agents.

- By 2023, 80% of consumer apps will be developed with a “voice-first” philosophy and 30% of customer service organisations will deliver proactive customer services by using AI-enabled process orchestration and continuous intelligence.

The role that an IT Service Provider may play

In this era, collaboration is key for companies to win the game of digital disruption. The fact that companies may lack some in-house expertise, in this particular case in AI deployment, represents an actual advantage for IT Service Providers which may play a major role.

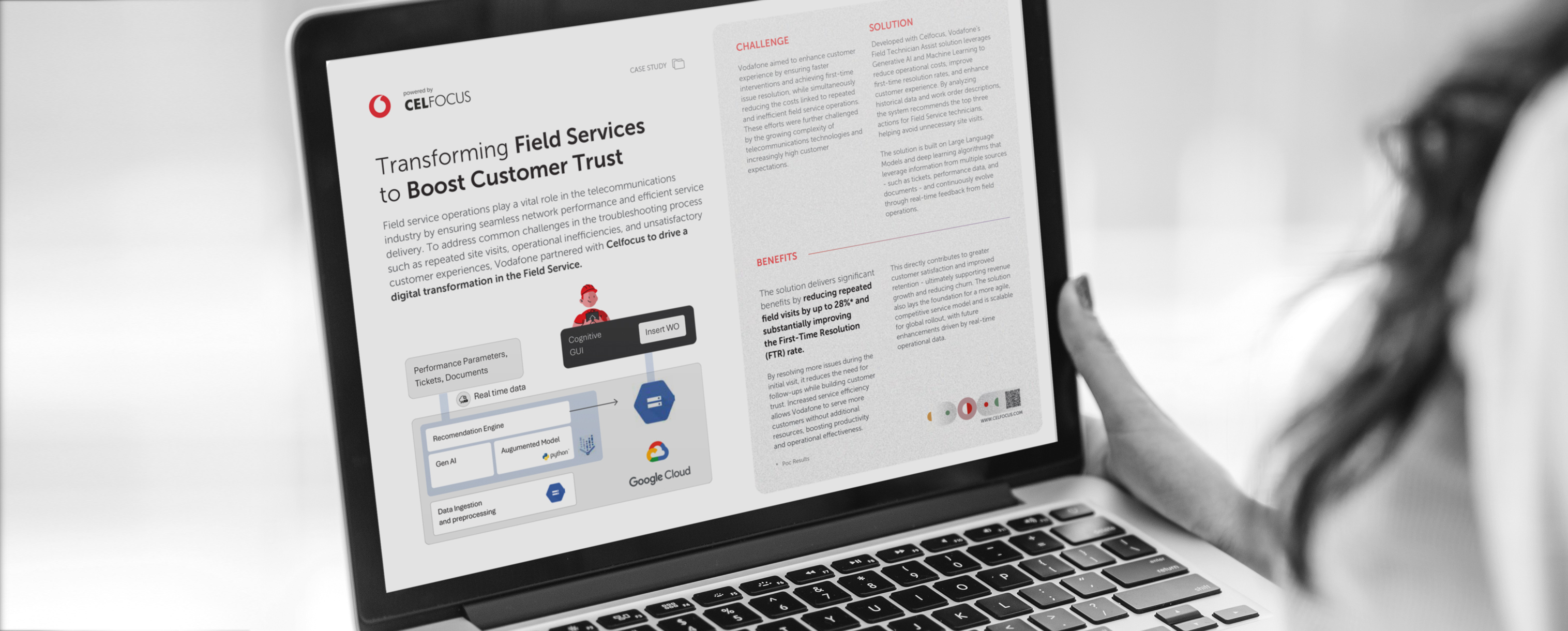

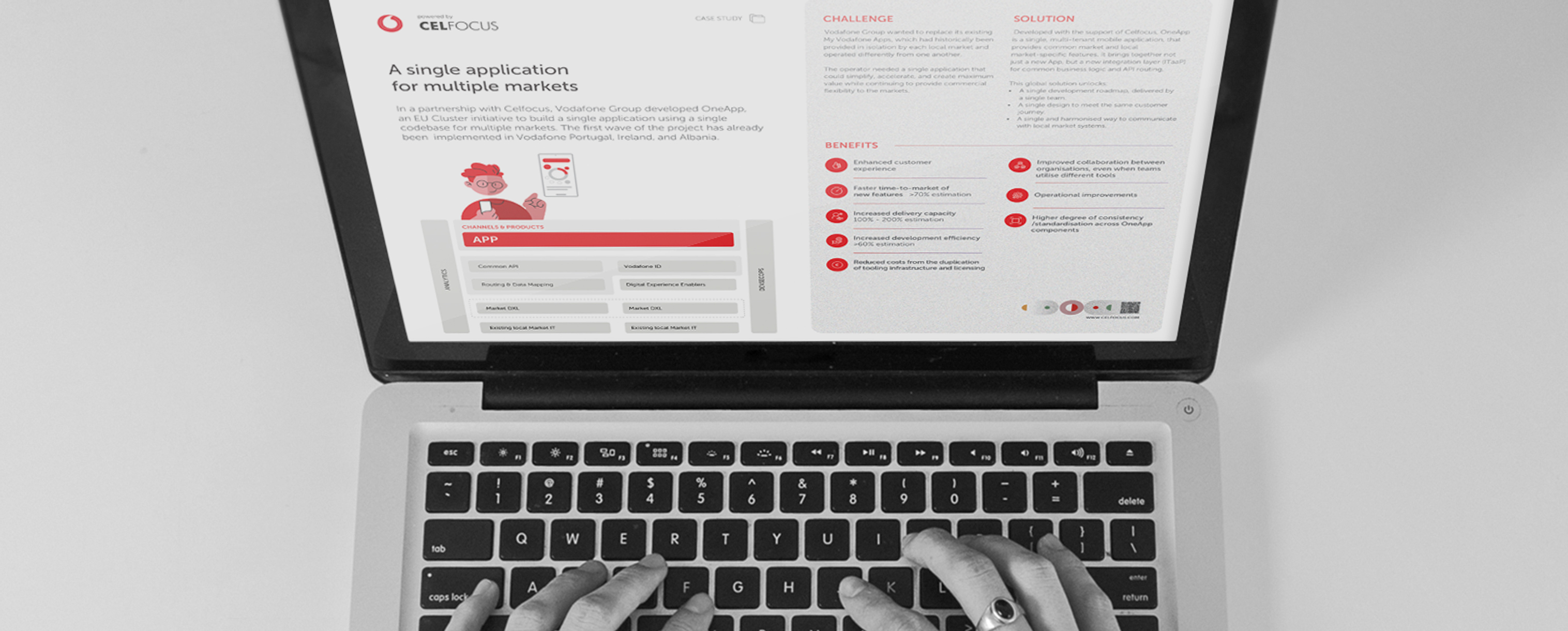

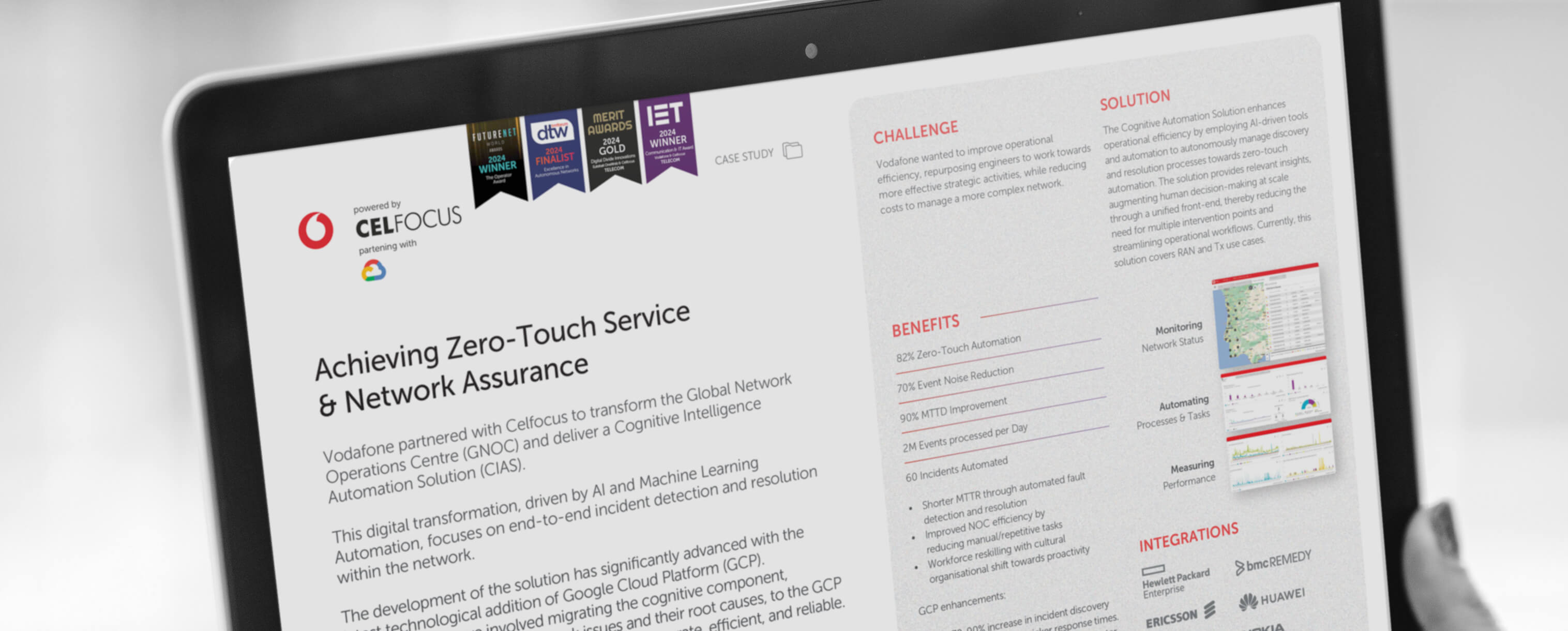

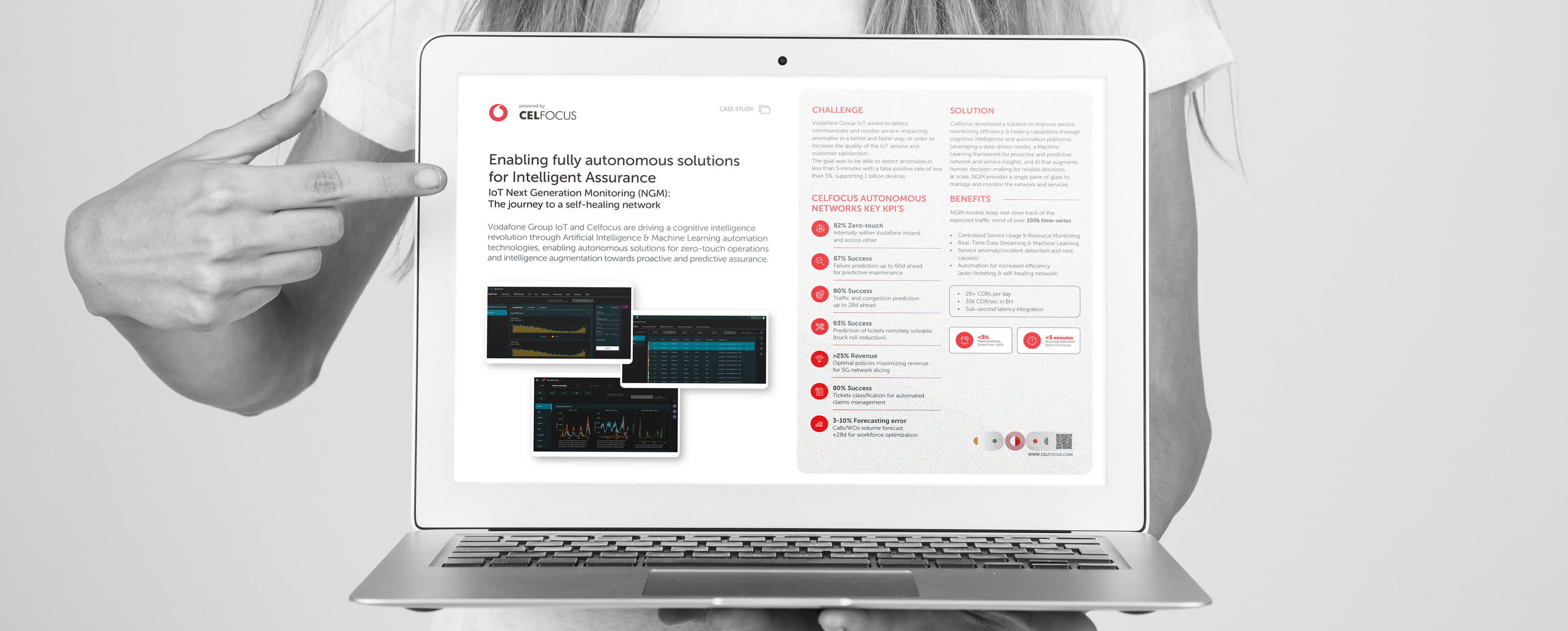

Facing the current challenges of the market and the need to enhance CX as a Digital Transformation source, Celfocus’s solution Customer Knowledge Augmentation and Activation aims at leveraging banks’ customer knowledge while delivering a service of excellence, thanks to its modular and integrated framework which is anchored in 2 main modules. The first comprises the tools and technologies to augment customer knowledge by activating every single customer through automated AI and Cognitive data insights. While the second one provides the possibility of delivering tailored experiences that trigger new targets, portfolios and customer lock.

The fact that Celfocus Customer Knowledge Augmentation and Activation framework is able to automate and orchestrate back office processes, while leading to shorter turnaround times, faster answers and transaction transparency, can serve the bank with an improved service, regardless of the channel used. As a result, the customer is at the centre of the experience as it should be – enhanced through the use of automated AI.

Learn more about Celfocus Customer Knowledge Augmentation and Activation here.

The bottom line

Organisations who will be successful and ultimately the winners in digital disruption will be those adopting a customer-centric approach, having the necessary skills to turn vision into reality and having a transitional process in place.

Since an enhanced customer experience should be at the centre of Digital Transformation, improving it through the end-to-end process must be the ultimate goal. It may seem a paradox but banks that can focus on the customers’ needs and emotions are the ones thriving in the long run in this digitalised world.

Emerging technologies, like AI, will not just impact companies’ businesses, but they will also modify the sectors in which they operate. Beyond that, in particular the banking industry, banks should team up with IT Service Providers to be delivered the necessary technological skills and deployment to assess and guide them through their transformational process.

[1] Maximizing Customer Value Through AI-Driven Relationships by Celent

[2] How to Use AI to Improve the Customer Experience by Gartner

References

- https://business-review.eu/tech/worldwide-spending-on-artificial-intelligence-systems-to-approach-usd-98-billion-in-2023-idc-finds-204490

- https://www.pwc.com/gx/en/industries/financial-services/assets/pwc-global-fintech-report-2017.pdf

- https://www.forbes.com/sites/cognitiveworld/2020/04/05/why-ai-is-transforming-the-banking-industry/#389767c07dd6

- https://www2.deloitte.com/content/dam/insights/us/articles/4687_traits-of-ai-frontrunners/DI_AI-leaders-in-financial-services.pdf

- https://www2.deloitte.com/content/dam/Deloitte/ca/Documents/audit/ca-audit-abm-scotia-ai-in-banking.pdf